How to check the balance of your NBAD Bank prepaid card? National Bank of Abu Dhabi (NBAD), also known as First Abu Dhabi Bank (FAB) is the largest and one of the safest banks in the UAE. NBAD offers many prepaid cards to help you avoid hassles and problems. If you are a client with a prepaid card and need to know how to check its balance, keep reading.

See also > “FAB bank balance check” 💰

NBAD Bank Balance Enquiry

Do you need to check the balance of your Ratibi prepaid debit card at NBAD? Just follow the steps below and check it on the free online balance inquiry portal:

Be sure you keep your NBAD prepaid card with you, as you will be asked to type some info from it.

- First of all, Go to the NBAD prepaid card system by clicking here

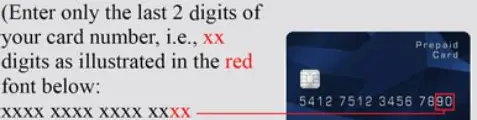

- Then, type the last two digits of your card number

- Enter the card ID number, which is at the bottom of the card’s front page.

- Now, click “GO”

- Once you have entered the correct details, you are taken to the “transactions screen“. This screen shows the last ten transactions on your account.

- You can quickly view the transactions by entering the number of transactions or the date of the transaction. The total balance, credit amount and debit amount are shown for each transaction.

NBAD Prepaid Cards

This is the list of prepaid cards offered by the bank suitable for the procedure above:

- Latibi Prepaid Card

- Green e-Dirham Prepaid Card

- E-Dirham Gold Card

- Blue e-Dirham Prepaid Card

- Red e-Dirham Prepaid Card

- Silver e-Dirham Prepaid Card

The e-Dirham Blue, Red, Green, Feather and Gold Cards have been developed in collaboration with the UAE Ministry of Finance. These cards can be used at most federal offices and many ministries in the UAE, and you do not need to have a bank account with FAB to apply for one of these cards.

NBAD PPC is a bank-developed system for querying NBAD prepaid card balances, which allows you to query NBAD prepaid card balances online easily and conveniently. Employers should train their employees on how to use the NBAD prepaid card system so that they can check the balance of their Ratibi cards at any time.

Ratibi services are offered according to the WPS guidelines in the UAE. WPS is a solution to the problem of low-income UAE workers whose monthly salary does not exceed AED 5,000 and who cannot use regulated financial products. On the other hand, employers are spared the costs and risks associated with paying wages by cheque or cash, as was the practice in the past.

Prepaid vs debit card

A prepaid card is a card issued by a bank or financial institution on which you can load the amount you want to spend. While a debit card is linked to your bank account and a credit card gives you a balance, you can buy a prepaid card with no bank transactions and no balance. You or a third party can load these cards, and you can do online and offline transactions until your balance is used up. So when you use a prepaid card, you don’t need to have credit. You use money that has already been deposited with a bank or financial institution.

NBAD Ratibi Prepaid Cards Guide

Ratibi payroll project was launched in 2008 by the National Bank of Abu Dhabi (NBAD) in order to provide faster and financial assistance to company employees. Ratibi prepaid card is intended to support companies to replace traditional payment methods such as checks. This will enable many companies to control the payment process while allowing their employees to exchange money through cash registers and ATMs all over the world.

Moreover, there is no need to open a bank account and maintain a minimum balance, making it a good option for employees with an annual salary of AED 5,000 or less.

Once the monthly transfer starts, the company can get the benefit of Ratibi card to automatically pay all employees. As a result, they get optimisation of costs, time and labour that are involved in printing and issuing cheques and cash as wage.

NBAD Ratibi main features

The main features of the NBAD Ratibi prepaid cards are:

- Unlimited access to major ATM networks and frequent flyer miles

- No minimum balance required by employees

- Free accident insurance is included with the card.

Policies and Procedures

- The employer will be the sole contact between the employee and the bank, as he/she has a business account with the bank.

- Employers are responsible for training staff in the use of the cards. This is very important as low-income workers often do not have the necessary experience to use modern banking facilities.

- A card can be withdrawn from an ATM for various reasons. In that case the Ratibi card will be declared invalid by the beneficiary bank. The employer must then apply for a new replacement card.

Criteria for Eligibility

For either employers or employees, here you have the eligibility criteria to use Ratibi:

- Employers must have a business account with the bank.

- To qualify for the card, employees must submit complete KYC documents as required by the FAB.

- Ratibi prepaid cards are issued only to residents of the United Arab Emirates.